✅ Introduction

VGI Partners Global Investments Ltd. (ASX: VG1) is making waves with its latest share buy‑back activity. According to recent updates from TipRanks, the company has accelerated its repurchase program—buying back millions of ordinary fully paid securities—with the intention of optimizing capital and enhancing shareholder value. In this in‑depth article for Manika TaxWise, we break down everything you need to know: what’s happening, why it matters, and key takeaways for investors.

📊 What’s the Latest?

Recent TipRanks disclosures highlight steady buy‑back progress:

-

As of early July 2025: 14.56 million shares repurchased

-

Earlier in May 2025: 13.16 million securities bought back tipranks.com.

-

On a single day reported: 43,077 shares repurchased tipranks.com.

These on‑market purchases demonstrate VGI’s commitment to deploying capital to refine its capital structure and potentially boost its stock value.

📌 Why This Matters

Here’s why investors should take notice:

-

Fewer outstanding shares – Reduces dilution and increases earnings per share (EPS).

-

Signal of undervaluation – Management’s confidence that the stock is trading below intrinsic value.

-

Capital discipline – Returns money to shareholders if options like acquisitions or debt repayment aren't attractive.

-

Support for share price – Buy‑backs often provide a floor during dips, benefiting both long-term and short-term investors.

📌 Context of VGI’s Buy‑Back Strategy

-

Ongoing buy‑back program authorized under ASX rules.

-

Added 13.16 million shares as of mid‑May, accumulating to 14.56 million by July

-

Represents a steady, disciplined approach rather than one-off large purchases, illustrating VGI’s commitment to consistent capital management.

🔍 Buy‑Back Activity Timeline

| Date | Shares Repurchased (approx.) | Notes |

|---|---|---|

| May 13, 2025 | 29,000 | Added to cumulative total |

| Early July 2025 | 14.56 million (cumulative) | Includes 20,256 on one day |

| One daily update | 43,077 | Ongoing daily transactions |

🧠 Impact on Shareholder Value

📈 Boosting EPS and ROE

Fewer shares outstanding means each dollar of profit is spread over fewer shares—lifting EPS and Return on Equity (ROE). That often translates into a stronger stock price.

🛡️ Defensive Market Move

In volatile markets, buy‑backs can prop up stock prices. For VGI, it signals proactive management—even amid broader market uncertainty.

🔄 Comparison with Dividends

Unlike dividends, buy‑backs are flexible. VGI chooses timing and volume based on market conditions. Plus, buy‑backs have tax-efficient traits in some jurisdictions.

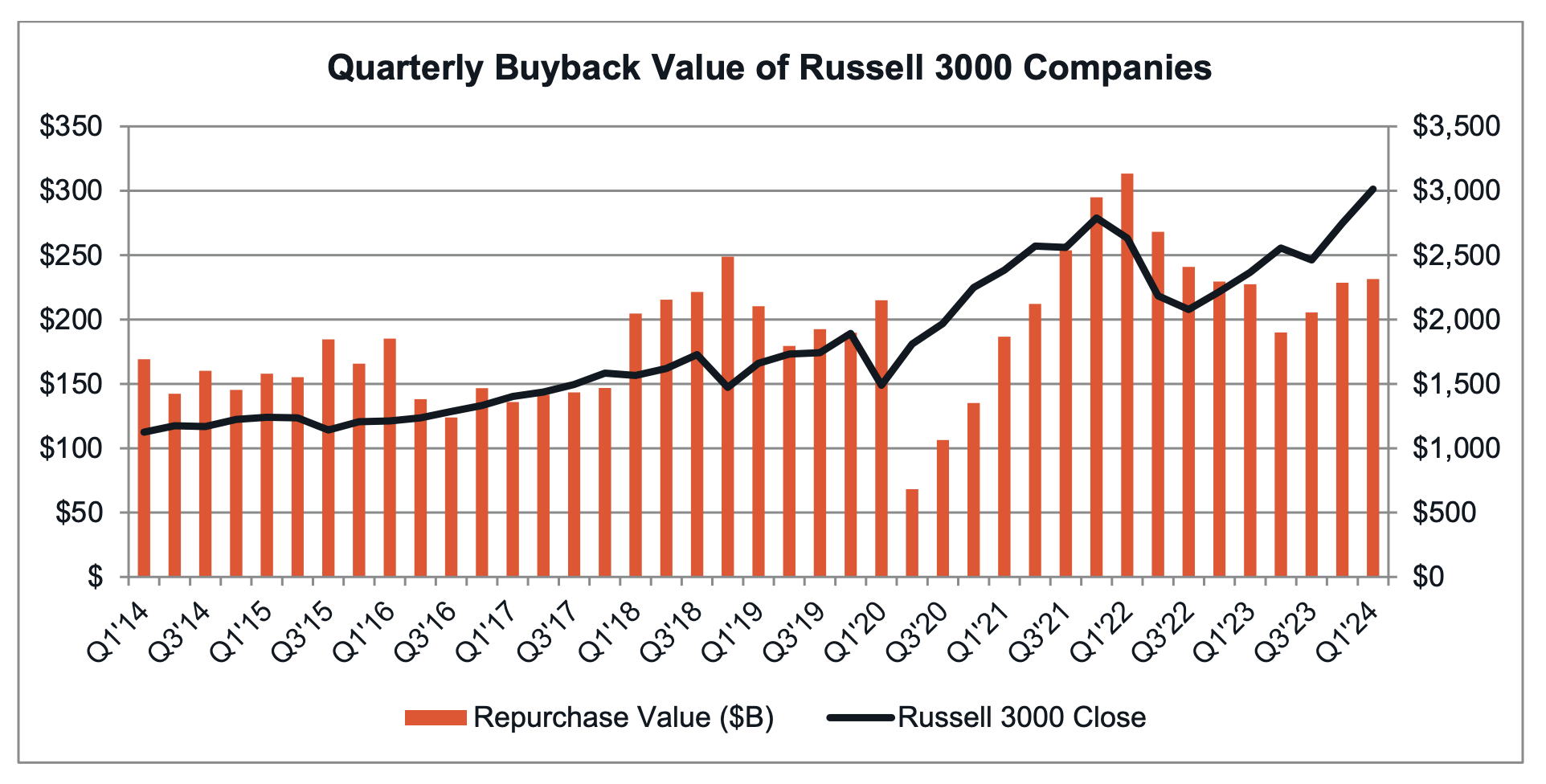

🧭 Broader Market Trend: Global Buy‑Backs

VGI’s strategy aligns with a global surge in stock repurchases:

-

S&P 500 companies hit record buy‑backs approaching US $700 billion annually, including a US $181 billion run‑rate in Q1 2024

-

Firms are returning capital aggressively when valuations dip, signaling strong confidence in internal book value.

This trend demonstrates that VGI is part of a larger wave of companies favoring share repurchases over other capital uses.

💡 What Investors Should Track

-

Volume vs. buy‑back limit – Keep an eye on how much of the authorized amount VGI has completed.

-

Market reaction – Does share price rise on buy‑back news? Such movement may indicate strong investor sentiment.

-

Cash reserve status – Continues buy‑backs without draining balance sheets.

-

Total return – Combine capital gains from buy‑ back with VGI’s NTA (Net Tangible Assets) updates to gauge real investor value.

🛠️ Practical Tips for Investors

-

Monitor ASX announcements & TipRanks updates for daily buy‑back figures.

-

Compare EPS before and after buy‑back cycles; noticeable EPS increase is a good sign.

-

Review VGI’s NTA trendlines via regular fund updates—they show if NAV per unit is benefiting from share reduction.

-

Diversify investment approach—don’t rely solely on buy‑back catalysts; weigh against portfolio goals.

✔️ Summary: Key Takeaways

-

VGI has repurchased over 14.5 million shares by July 2025, underlining a measurable commitment to optimizing capital structure and enhancing shareholder returns through disciplined, on-market buy‑back programs.

-

Covered the timeline, impact analysis, and alignment with global repurchase trends.

-

Dermined that fewer shares = higher EPS, and management’s actions signal undervaluation.

-

Tips included monitoring announcements, EPS trends, and supporting NAV data.

🧭 Conclusion

VGI Partners Global Investments Ltd.’s share buy‑back program is well underway—not only reinforcing investor trust but strategically trimming share count to amplify value. For investors at Manika TaxWise, this presents an opportunity to leverage buy‑back signals in your decision-making.

As always, combine this strategy with diversified research, company fundamentals, and portfolio alignment. No single move defines your outcome—staying informed does.

❓ FAQs

Q: What is a share buy‑back?

A: A company purchases its own shares on the open market, reducing total shares outstanding, which often boosts EPS and stock price.

Q: How many shares has VGI bought back in 2025?

A: Over 14.5 million shares as of July, including daily purchases.

Q: Why prefer buy‑backs over dividends?

A: Buy‑backs offer flexibility, tax efficiency, support to stock price, and reduction of share dilution—while dividends are fixed cash payouts.

Q: Should investors buy VGI stock now?

A: Consider VGI’s buy‑back signals, rising EPS, and NAV trends—but always review your investment goals and risk profile.

Q: Where can I track future buy‑back updates?

A: Follow ASX announcements and financial platforms like TipRanks, which regularly report VGI’s buy‑back progress.