Introduction

A coalition of tax professionals, charitable

trusts, and industry bodies has petitioned the Central Board of Direct Taxes

(CBDT) to extend the deadlines

for filing tax audit reports under

Section 44AB and renewing Section

12A/12AB registration. The plea, made in September 2025, cites

delays in form availability, portal glitches, and procedural burden as key

obstacles. If granted, the extension could provide relief to thousands of

businesses and nonprofits scrambling to meet simultaneous compliance

obligations.

Background & Context

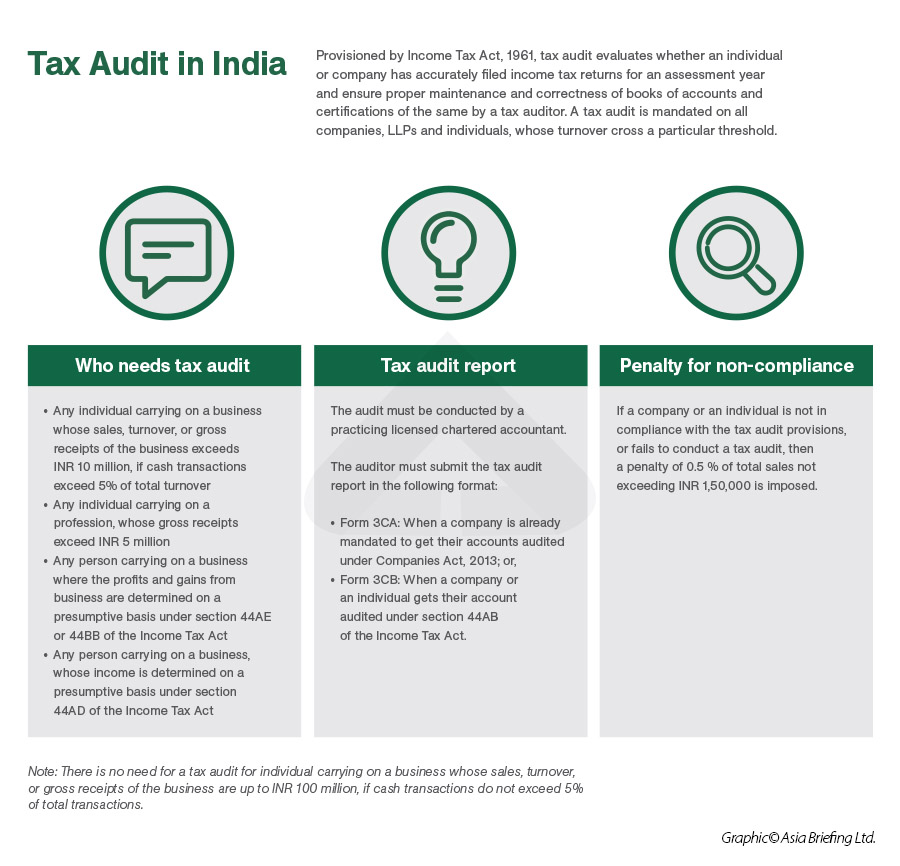

What is a tax audit under Section 44AB?

Under the Income Tax Act, Section 44AB mandates

that certain businesses and professionals submit a tax audit by a specified due

date:

·

Entities whose turnover exceeds prescribed

thresholds must get their accounts audited by a Chartered Accountant and

the audit report submitted to the Income Tax Department.

·

For FY 2024-25 / AY 2025-26, the due date for

the audit report is 30

September 2025.

·

The related ITR (income tax return) for audited

entities must follow—typically by 31

October 2025, unless further extension is granted.

·

Non-compliance can attract penalties under Section 271B (0.5% of

turnover or gross receipts, with a cap) unless a reasonable cause is shown.

The audit requirement ensures that accounts,

deductions, and income declarations are verified by an independent professional

to reduce tax evasion risk and improve reliability.

What is Section 12A / 12AB registration and

renewal?

Charitable trusts, religious institutions, and

NGOs often seek tax exemption by registering under Section 12A / 12AB

(sometimes colloquially “12A”). Key facts:

·

From 1

April 2021, new registrations under 12A/12AB are granted for five years, and require renewal every 5 years.

·

Organizations whose registration expires on or

before 31 March 2026 must apply for renewal (via Form 10AB) by 30 September 2025.

·

The Finance Act, 2025 has introduced a rule: if

a trust’s total income (before exemptions) did not exceed ₹5 crore in each of

the two preceding years, the renewed registration may be granted for 10 years instead of 5.

·

Failure to renew in time can lead to loss of

exemption benefits or being subject to tax on “accreted income” under Section 115TD in extreme

cases.

Why is this news significant?

This dual request—extending both tax audit

deadlines and 12A renewal dates—reflects mounting pressure from practitioners

and nonprofits who argue the current timelines are unrealistic under existing

constraints. Missing these deadlines could have serious financial and legal

consequences. The CBDT’s decision will therefore affect compliance burden,

litigation risk, and administrative capacity across sectors.

Detailed Explanation of the Request

Who is making the request?

Several bodies have formally requested relief:

·

BCAS

(Bombay Chartered Accountants’ Society) in a representation to

CBDT seeks that the current deadline of 30

September 2025 be extended to 31 December 2025 for 12A

renewals.

·

The ICAI’s

Central India Regional Council (CIRC) has reportedly suggested

a December 2025 deadline for tax audit filing, citing complexities in

compliance.

·

The All

India Federation of Tax Practitioners (AIFTP) has also moved

the Delhi High Court to direct CBDT to extend both ITR and audit deadlines.

What are the objections / grounds cited?

The petitioners highlight multiple challenges:

·

Delay

in finalizing audit & ITR utility forms — repeated

revisions slow down planning.

·

Technical

glitches in the income tax filing portal, AIS mismatches, and

system overload.

·

Simultaneous

deadlines — 12A renewal, audit reporting, and ITR filing

overlap, squeezing time.

·

High

volume of applications from trusts needing renewal, making

timely processing difficult.

·

Exposure

to punitive tax implications (e.g. under Section 115TD) for

trusts that miss renewal due to procedural delays.

What exactly is being asked?

The relief sought includes:

1.

Extension

of tax audit report due date (Section 44AB) beyond 30 September

2025, ideally to 31 December 2025

or another reasonable window.

2.

Extension

of 12A/12AB renewal deadline from 30 September 2025 to 31 December 2025 for

organizations whose registration expires by March 2026.

3.

A one-time

condonation window for organizations that fail to renew on

time.

4.

Review of procedural

hurdles and portal delays that hamper timely compliance.

The intention is to give both taxpayers,

auditors, and nonprofit organizations breathing space—without forcing

noncompliance.

Impact Analysis

Benefits & Risks for Different

Stakeholders

Businesses / Taxpayers subject to audit

Potential

benefits:

·

More time to reconcile books, prepare reports,

and avoid hasty errors.

·

Less likelihood of penalties under Section 271B

due to missed deadlines (especially if “reasonable cause” is argued).

·

Relief from overlapping compliance stress (audit

+ ITR + other statutory tasks).

Potential

drawbacks / considerations:

·

The extension is not guaranteed; taxpayers may

still face uncertainty.

·

Delay in finalizing tax positions may affect

financial forecasting or stakeholder reporting.

·

Some may misuse the extension to procrastinate.

Charitable Trusts / NGOs (12A / 12AB

registrants)

Potential

benefits:

·

Breathing room to gather documents, prepare

audited accounts, and file renewal forms.

·

Avoid abrupt disruption of tax-exempt status or

donor confidence loss.

·

Avoid punitive consequences such as tax on

accreted income.

Possible

risks:

·

If the extension is denied, those who missed the

deadline may face loss of exemption or required to reapply from scratch.

·

Administrative backlog could still delay

approvals even after extension.

Auditors / CA Firms / Tax Practitioners

Positive

impacts:

·

Reduced pressure during peak compliance season.

·

More realistic timelines to handle client load

and portal delays.

·

Better scope to incorporate recent changes (e.g.

revised schedules, enhanced disclosures).

Challenges:

·

The extension could compress other deadlines

later.

·

Firms must manage client expectations and avoid

last-minute rushes.

·

Additional burden in handling condonation or

retrospective corrections.

Broader economy / fiscal

·

A smoother compliance window may reduce

litigation and scrutiny burden on tax authorities.

·

However, any extension also compresses audit

capacity in later months, potentially increasing backlog.

·

Delay in finalizations may slow the revenue

collection cycle in borderline cases.

Common Misunderstandings (and pitfalls)

·

“If

deadline is extended, no penalties will ever apply.”

Extensions often come with safeguards; delayed submissions may still invite

scrutiny if deemed unreasonable.

·

“12A

renewal wasn’t mandatory previously.”

Earlier, 12A was often perpetual. Post-2021 reforms make periodic renewals

mandatory.

·

“Any

missing date can be condoned automatically.”

Condemnation is discretionary, not automatic, and typically requires

justification.

·

“Extension

for 12A means extension for 80G too.”

These are separate registrations; extension of one doesn’t automatically apply

to the other.

·

“All

taxpayers can take this extension benefit.”

The extension request is specific to audit/non-audit categories; general

non-audit cases already have separate deadlines.

Expert Commentary

From my two decades of observing Indian tax

reform cycles, this dual extension request marks one of the few times

institutional pressure intersects both the corporate and nonprofit sectors

simultaneously. The convergence is telling: compliance timelines, especially in

the digital era, must be realistic to prevent counterproductive defaults. If

CBDT accommodates this request, it could create a precedent for more

responsive, flexible tax administration in future years.

A former CBDT official, now in private

practice, notes:

“Deadlines are necessary for discipline, but

inflexibility in the face of systemic delays undermines both revenue goals and

taxpayer confidence.”

Conclusion & Action Steps

The push to extend tax audit and 12A renewal

deadlines reflects a genuine compliance crunch. Businesses, professionals, and

nonprofits are squeezed by tight timelines, portal glitches, and evolving form

formats. While CBDT has not yet committed to relief, the strength and

coordination of representations could influence its decision.

What

stakeholders should do now:

1.

Monitor

CBDT announcements—extensions, circulars, or notifications may

arrive late.

2.

Prepare

early, draft audits / accounts in parallel, and assemble

documents for 12A renewal even ahead of formal green light.

3.

Document

any delay causes (portal errors, form delays, etc.) to support

reasonable cause submissions if deadlines are missed.

4.

Engage

with professional bodies and legal counsel to monitor writs or

court orders that could alter the standing deadline.

In coming weeks, the tax community will

closely watch whether CBDT accedes to the request. If extensions are granted,

2025 could become a turning point in how India balances compliance rigor with

administrative practicality.

FAQs

Q1:

Has CBDT already extended any deadlines for FY 2024-25 audit or 12A renewals?

No official extension has been confirmed as of now. Stakeholders are awaiting

CBDT’s response to representations.

Q2:

Why is 30 September 2025 the renewal date for 12A?

Because registrations expiring by 31 March 2026 must apply six months prior for

renewal, making the deadline 30 September 2025.

Q3:

What penalties or risks do trusts face if they miss 12A renewal?

They risk losing their tax-exempt status or incurring tax on accreted income under Section

115TD.

Q4:

Can the deadline for both audit and renewal be extended simultaneously?

Yes—that’s precisely what petitioners are requesting. But each extension is

governed by different statutes and CBDT discretion.

Q5:

Should SMEs or small charitable trusts also worry?

Only if they’re required to undergo audit (meeting thresholds) or their 12A

registrations fall due. Smaller entities not needing audits may follow standard

non-audit timelines.

Sources & References

1.

Income tax audit dates and penalties details — Livemint

2.

Renewal of 12A/12AB registration, forms, timelines —

ClearTax, AccountingNGOs

3.

Representation by BCAS to CBDT for extension — BCAS

petition document

4.

AIFTP’s writ application to extend audit and ITR

deadlines — Livemint

5.

ICAI regional body’s request for extended audit

deadline — Finance news

6.

General NGO 12A/80G renewal guidelines —

IncometaxforNGOs, etc.

.png)